Butterfly option spreads are a type of spread trade that is used to trade the underlying asset. The butterfly spread is one of the most popular strategies for trading stocks or ETFs. It is also used to trade commodity futures and options, forex, and commodities such as gold, silver, copper, and oil.

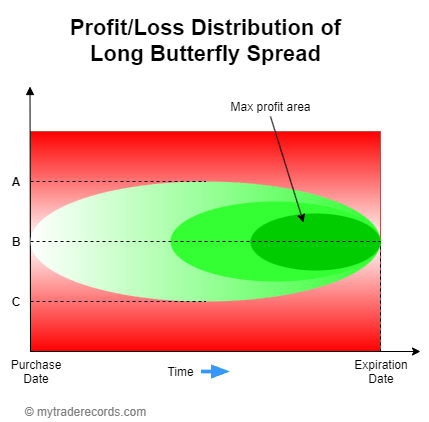

Butterfly option spreads are very useful for a small trading account. Being a more complicated trading instrument it is the most advanced risk-to-profit way of trading. The butterfly option spread consists of three separate trades with the same expiration date: a middle strike price and two outer strike prices.

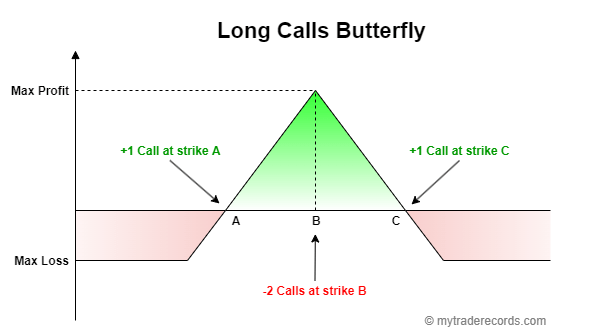

Long Calls Butterfly:

- Buy two calls at different strike prices

- Sell two calls at the strike price that is between the bought calls.

For example, you can buy one butterfly spread of 3 calls:

XYZ +1 CALL $22 (9/2/22)

XYZ -2 CALL $24 (9/2/22)

XYZ +1 CALL $26 (9/2/22)

Your max profit will be at the expiration date (or close to the expiration) when the stock price will be close to or equal to $24.

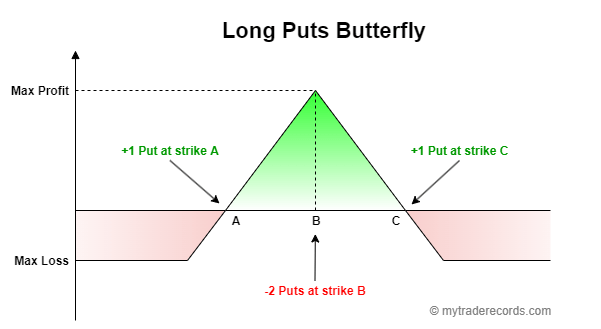

Long Puts Butterfly:

- Buy two puts at different strike prices

- Sell two puts at the strike price that is between the bought puts.

For example, you can buy one butterfly spread of 3 puts:

XYZ +1 PUT $22 (9/2/22)

XYZ -2 PUT $24 (9/2/22)

XYZ +1 PUT $26 (9/2/22)

Your max profit will be at the expiration date (or close to the expiration) when the stock price will be close to or equal to $24.